Apple Posts Its Second-best Quarter Ever: Tech Analysts Run For Cover!

by May 1, 2015 3,283 views2

After posting the biggest quarter in corporate history last year, Apple has posted its second-best quarter ever. If there was ever a doubt about the iPhone being the best-selling gadget of all-time that argument should be put to rest now. The iPhone 6 and the iPhone 6 Plus sales results have bettered all market predictions. Even the most bullish predictions have gone for a toss.

Here are some staggering numbers from Apple’s second quarter results, which also happens to be its second-best quarter ever:

- Last quarter Apple sold 74.5 million iPhones prompting analysts to predict that the sales of the iPhone had peaked too early. This quarter Apple reportedly sold 61.17 million iPhones. Analysts had predicted that number to be somewhere around 57 million.

- Apple also sold 12.6 million iPads and 4.6 million Macs this quarter. While iPad sales declined by 23%, Mac sales grew by 10%, compared to the year-ago quarter. iPhone sales grew by 40%. The iPhone 6 is available in India through ShopClues, currently priced at Rs. 43,999 for the 16 GB version.

- Apple followed its historic first quarter net profits of $18 billion with net profits of $13.6 billion this quarter. This meant that Apple followed its phenomenal $74.6 billion revenue results with a more than impressive $58 billion in revenues this quarter. This revenue figure is also above what analysts had predicted.

What do these staggering numbers mean for Apple?

It’s important to note that Apple was able to record these remarkable numbers largely because of its international sales, China in particular. While a galaxy of Android based smartphone vendors have been shipping smartphones of all shapes and sizes, the iPhone 6 and the iPhone 6 Plus were essentially Apple’s first “big-screen” devices.

Even though the insane surge in Apple’s revenue in the last 2 quarters is not likely to continue at the same pace, this growth has meant that Apple is now sitting on a cash pile of $194 billion. Only Tim Cook knows what can be achieved with that kind of cash but there is no doubt that Apple will be looking to use some of this cash in acquisitions because without much media coverage Apple has made 27 acquisitions in the last 6 quarters.

What does Apple’s projected growth trajectory looks like?

Some skeptics, better known as analysts, have already started predicting a sizable decline in Apple’s profits and revenues, as they did last quarter. Even a sophomore interested in economics can tell you that it’s not possible for any company, let alone for a public company to record profits and revenues to the tune of what Apple has achieved in the last 2 quarters.

When Apple recorded the biggest quarter in corporate history, in January 2015, it should have been clear to anyone observing that if no public company had ever recorded profits worth $18 billion then it must be fairly difficult to achieve that mark in consecutive quarters for even the company that achieved it. Despite a decline in profits and revenues since last quarter Apple’s chances of putting together a fairly reasonable performance this year are pretty good.

This optimism stems from two factors. Firstly, services is now alone a $5 billion business for Apple. The Cupertino, California based company reported that this quarter saw an all-time record performance by the App Store. This clearly means that Apple’s revenues in the near future may not be entirely dependent on the iPhone sales. It is well documented that the iPhone is the greatest gadget of all-time and this beast will slow down eventually, but equating iPhone sales and a decline in iPad sales with a disaster for Apple in terms of revenues is stretching it a little too far.

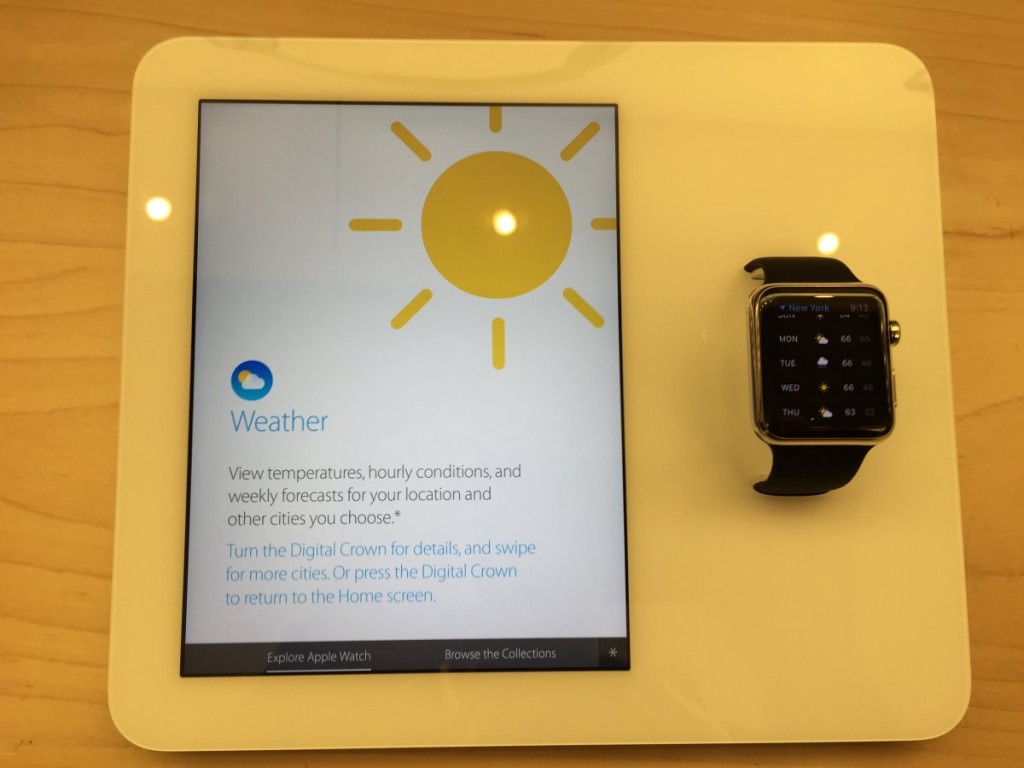

Secondly, Apple has a new product in the market. It was the most widely awaited tech product since perhaps the iPad and whether its legacy matches up to the iPhone’s cult status is something only time can tell. What I can tell you is that this new Apple product, the Apple Watch, became the best-selling gadget of all-time in its category on the day of its launch.

According to market research firm Slice Intelligence, Apple sold approximately 957,000 Apple Watches on day one. That’s more than what Google’s Android Wear based smartwatches from Samsung, LG, and others sold combined in an entire year – 720,000 units. And customers aren’t ordering just one Apple Watch, according to Slice’s data customers ordered an average of 1.3 watches each. Need we discuss the fate of this new Apple product for the rest of the year? I think not.

While a majority of analysts get a majority of things right about most companies, there seems to be a common denominator among analysts who track Apple’s progress. Most of them think innovation at Apple is dead and growth at Apple has always been innovation driven. What they fail to understand is that innovation isn’t your early morning sushi; it isn’t an everyday event. The fact that the Apple Watch is Apple’s first new product in 5 years is testimony to how hard it is to build a new category of products. The fact that the Apple Watch is already destroying records despite its competitors getting a one year head start is testimony to the fact that building high quality products is even harder.

Ditch the analysts for a bit and expect Apple Inc. to record another strong fiscal year.

![Lenovo Is Arguably The Most Complete Consumer Electronics Brand In The World Today! [Analysis] lenovo](https://www.ispyprice.com/blog/wp-content/uploads/2015/04/lenovo-e1431756546912.jpg)